Squarespace Payments vs Stripe: 7 Crucial Differences

If you accept money on your Squarespace site, whether through your e-commerce store or by taking deposits through your online booking system, you need to set up a payment processor.

Squarespace offers Squarespace Payments, an in-built platform with a lot of features. However, many Squarespace users swear by Stripe.

Which one should you use on your Squarespace website? In this article, we’ll take a look at the pros and cons of each payment processor and help you determine which one is right for your needs.

The takeaway

Squarespace Payments and Stripe are payment processors you can use to accept payments and manage transactions on your Squarespace website

Both platforms have similar payment fees (although you can get a cheaper rate if you are on a more expensive Squarespace plan)

The main advantage of Squarespace Payments is that everything is integrated into your Squarespace website, making it easy to keep track of your finances

However, Stripe has more features—you can use it outside of your Squarespace site, accept a wider range of payment types, and use terminals to accept payment in your brick-and-mortar store

Remember that Squarespace Payment is still new, so additional features may be rolled out in the future

Stripe vs Squarespace Payments: 7 things to consider

From processing fees to additional features, let’s see which payment platform is the best choice for your business.

1. Squarespace Payments is accessible through your website

The key advantage to choosing Squarespace Payments is that it’s directly integrated into your Squarespace site. This means you can review your payments and see what’s being processed through an easy-to-use dashboard on your site.

With Stripe, you can view some basic information through Squarespace, but to see anything more detailed, you need to log in to your Stripe account.

2. You can use your Stripe account outside of Squarespace

Squarespace Payments is designed for processing payments on your Squarespace site, so you can’t use it to accept offline payments or payments through your social media channels.

Stripe is a lot more flexible—for example, you can generate links to sell offline, as well as manage payments across multiple Squarespace sites.

3. Squarespace Payments is cheaper (in some situations)

Squarespace Payments and Stripe charge the same debit and credit card processing fees in most scenarios – 2.9% plus $.30 per transaction.

So, if you’re selling a $100 annual membership to your website, that means you take home $96.80 after Squarespace Payments or Stripe takes its share.

However, if you’re on the Plus Squarespace plan, this comes down to 2.7% plus $.30. And if you’re on the Advanced Plan, it comes down even further to 2.5% plus $.30!

This means that if you plan to sell a lot of products or services online, it may be worth upgrading to a more expensive Squarespace plan.

(The final fee you pay on both platforms may vary depending on the payment type and if currency conversion is required.)

4. Stripe accepts in-person payments

If you operate a brick-and-mortar store, you can use Stripe Terminal to accept in-person payments and sync your online and offline inventory.

Squarespace Payments doesn’t have an in-person payment system at this moment in time.

5. Stripe accepts more payment methods

Squarespace Payments accepts a decent range of payment methods, including Apple Pay, Klarna, Link, ACH, and most credit and debit cards.

However, Stripe accepts even more, including BACs, SEPA, Google Pay, Alipay, and PayPal. The options available to you will depend on the regions you operate in.

6. Stripe accepts a wider range of currencies

With Squarespace Payments, you may be more limited in the different types of currencies you can accept.

For example, if you’re in Canada, you can only accept USD and CAD. However, if you use Stripe, you can accept over 130 different currencies.

7. Squarespace Payments doesn’t work with Acuity

If you use Squarespace Scheduling (Acuity Scheduling) to offer appointments to customers, you can’t use Squarespace Payments to accept payments.

You can accept payments through Stripe and aggregate them through your Stripe dashboard.

So Squarespace Payments vs Stripe: Which is best?

It ultimately comes down to freedom versus convenience.

The main benefit of Squarespace Payments is that you can access it through your website, saving time and meaning you can manage all your orders in one place.

Stripe doesn’t let you do this, but it has a lot more flexibility – you can accept a wider range of currencies and payment methods, and generate orders outside of your website.

We love how easy Squarespace Payments is to use and get started with, but we also love how Stripe provides such an extensive range of services.

Bear in mind that Squarespace Payments is still new, and new features are likely to be implemented in the future.

We’ll keep you up to date with the latest developments.

Stripe vs Squarespace payments FAQ?

Got any other questions about Squarespace payments or Stripe? You’ll find the answers here!

Can you use both Stripe and Squarespace Payments on your website?

No, you have to choose between one or the other.

You can use Squarespace Payments and PayPal together though, as Squarespace Payments doesn’t have a PayPal option.

Can you use Squarespace Payments on multiple Squarespace sites?

No—you need a Squarespace Payments account for each website you operate.

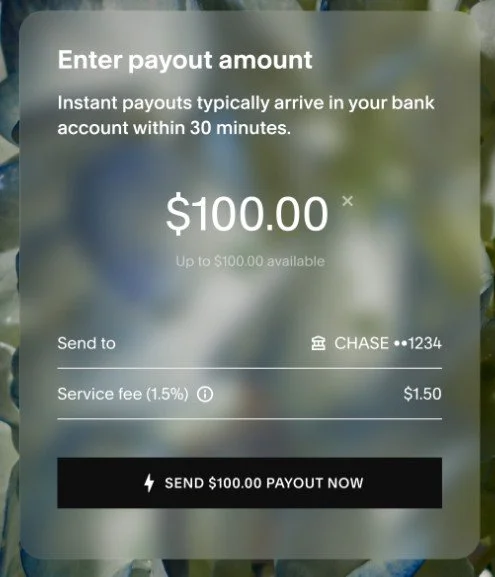

Do both platforms offer instant payouts?

Yes—both Squarespace Payments and Stripe offer instant payouts. This means that if you have the funds in your account and are eligible, you can send the money to your bank straightaway.

The service fee in Squarespace Payments is 1.5%. The service fee in Stripe varies between 1% and 1.5%, depending on which country you are in.

What software does Squarespace Payments use to accept payments?

Interestingly, Squarespace Payments is powered by Stripe!

What if I don’t want to use Stripe or Squarespace Payments?

If you don’t want to use either payment processor, you can connect PayPal to your site instead.

Squarespace Payments or Stripe… Which one will you use to accept payments on your website?